- Home

- Resource

- Explore & Learn

- Post-Pandemic Marketing Strategies for IVD Distributors: A Case Study of PT. Sinergy Diagnostic

- Home

- IVD

- By Technology Types

- By Diseases Types

- By Product Types

- Research

- Resource

- Distributors

- Company

The in vitro diagnostics (IVD) industry has long been a cornerstone of the healthcare sector, enabling accurate and timely disease detection. The COVID-19 pandemic, however, catapulted the IVD industry into the global spotlight, drastically altering market dynamics. PT. Sinergy Diagnostic, an established IVD distributor in Indonesia, has navigated these turbulent waters, and its post-pandemic journey offers valuable insights into the evolving IVD distribution landscape.

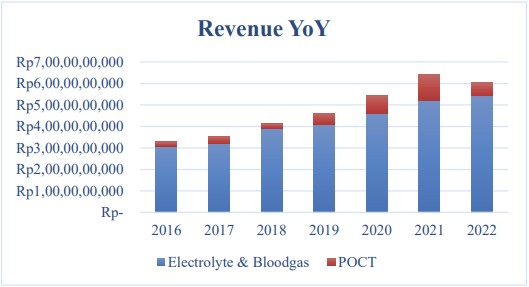

Fig.1 PT Sinergy Revenue Realization 31/12/2022. (Mulya M. K. F., et al., 2024)

Fig.1 PT Sinergy Revenue Realization 31/12/2022. (Mulya M. K. F., et al., 2024)

Company Background

PT. Sinergy Diagnostic, with a 17-year-long history, has firmly rooted itself in the Indonesian IVD market. Starting as a CV. Sinergy Diagnostic was founded in 2004 and, later rebranding, it has its headquarters in Bandung, West Java. The company has built an extensive clientele network, serving major hospital groups such as Hermina, Hasna Medika, and Mitra, public hospitals (RSUD) in regions like Cianjur and Tasikmalaya, and private institutions like Santosa Hospital Central and RS Advent.

Business Model: Kerjasama Operasi (KSO)

A defining feature of PT. Sinergy's success is its use of the Kerjasama Operasi (KSO) or Operational Cooperation model. In this model, the company provides diagnostic equipment to laboratories. In return, the laboratories commit to purchasing reagents from PT. Sinergy or sharing test volume data. The KSO process is a well-structured five-stage affair:

The COVID-19 pandemic led to an unprecedented surge in the demand for Point of Care Testing (POCT). PT. Sinergy Diagnostic witnessed a dramatic shift in its sales trends. Before the pandemic, its Electrolyte & Bloodgas Analysis (EBA) products consistently generated higher revenue. However, in 2020, as the pandemic took hold, the need for rapid diagnostic testing for COVID-19 led to a spike in POCT sales. In 2021, POCT sales peaked at Rp1.218 billion. This was a stark contrast to the pre-pandemic period when EBA was the revenue driver.

As the world gradually adapted to living with the virus and vaccination rates increased, the demand for POCT, especially for COVID-19 testing, plummeted. In 2022, POCT sales at PT. Sinergy Diagnostic dropped to Rp 602 million. This sharp decline posed a significant challenge to the company's revenue stability, forcing it to reevaluate its business strategy.

Market Segmentation

PT. Sinergy Diagnostic has identified distinct market segments:

Targeting

The company has strategically chosen to focus on Type B-C hospitals, smaller public facilities, and private laboratories. By avoiding direct competition with manufacturers for Type A hospitals, which often purchase directly from the source, PT. Sinergy can better serve the needs of its targeted segments. For example, it can offer customized packages that include equipment, reagents, and training to private laboratories.

Positioning

PT. Sinergy positions itself as a reliable partner that understands the unique needs of each segment. It emphasizes its ability to provide quality products, technical support, and cost-effective solutions tailored to the specific requirements of its clients.

Customer Insights

A study involving 15 key respondents from different healthcare institutions revealed some critical customer insights:

Product Strategy

Diversifying Beyond POCT

While POCT remains part of its product portfolio, PT. Sinergy Diagnostic is actively diversifying its product offerings. It is strengthening its EBA product line and expanding into other areas. The current product portfolio includes:

Pricing Strategy

The company adopts a value-based pricing approach. It considers the perceived value of its products in the healthcare setting, its competitive positioning, the financial capabilities of different customer segments, and the potential for long-term partnerships. For example, for cost-sensitive Type D hospitals/Puskesmas, it may offer more affordable pricing packages that include both equipment and reagents.

Place (Distribution) Strategy

PT. Sinergy Diagnostic focuses on ensuring wide distribution across West Java. In urban areas, it targets private laboratories and Type B-C hospitals through direct sales and partnerships with local distributors. In rural areas, it collaborates with local healthcare authorities to reach Puskesmas and smaller facilities. Efficient logistics are in place to ensure the timely delivery of products, especially reagents, which are often time-sensitive.

Promotion Strategy

The company's promotional efforts are centered around educating healthcare providers about the importance of accurate diagnostics in improving patient outcomes. It showcases its technical expertise and support capabilities through webinars, product demonstrations, and case studies. Success stories from existing partnerships are also shared to build trust and credibility. For example, it may highlight how a private laboratory increased its diagnostic accuracy and patient satisfaction after using PT. Sinergy's products.

People (Human Resources) Strategy

In the IVD industry, where technical knowledge and customer service are crucial, PT. Sinergy invests heavily in its people. Staff are provided with regular technical training to keep up with the latest diagnostic technologies. Customer service representatives are trained to be responsive and empathetic, understanding the critical nature of healthcare operations. Specialized teams are also in place to handle different customer segments, ensuring that the unique needs of each are met.

Process Strategy

The company has refined its operational processes to ensure seamless service. Installation of equipment is now more efficient, with on-site training provided to healthcare staff. Proactive maintenance schedules are in place, and quality control protocols are strictly adhered to. A responsive customer feedback mechanism has been established, allowing the company to quickly address any issues or concerns raised by clients.

Physical Evidence Strategy

To build trust with its customers, PT. Sinergy Diagnostic uses physical evidence. Its modern office and service facilities are designed to showcase its professionalism. Certifications and compliance with quality standards are prominently displayed. Case studies and success metrics are made available to clients, and equipment demonstrations are often held at its facilities to give potential customers a hands-on experience.

Diversification and Expansion

The company plans to further diversify its product portfolio beyond its current offerings. This includes exploring new diagnostic technologies such as next-generation sequencing-based diagnostic tools for genetic diseases. It also aims to expand its KSO partnerships, particularly with emerging private laboratories and rural healthcare facilities that are looking to upgrade their diagnostic capabilities.

Technology Adoption

PT. Sinergy Diagnostic is committed to adopting advanced diagnostic technologies that can address long-term healthcare needs. This may involve investing in artificial intelligence-powered diagnostic software that can analyze complex test data more accurately and efficiently.

Data-Driven Decision Making

The company will continue to leverage customer insights to develop targeted solutions. By analyzing data on customer preferences, purchasing behavior, and feedback, it can tailor its product offerings, pricing, and marketing strategies to better meet the needs of its diverse customer base.

Service Excellence

Enhancing maintenance and support capabilities will remain a top priority. This includes training a larger team of technical support staff, improving response times, and offering more comprehensive after-sales services. By providing exceptional service, PT. Sinergy can differentiate itself from competitors and build long-term loyalty among its customers.

The post-COVID-19 era has presented both challenges and opportunities for PT. Sinergy Diagnostic. The company's ability to adapt its business model, product offerings, and marketing strategies in response to the changing market dynamics is a testament to its resilience. By focusing on diversification, customer-centricity, and service excellence, PT. Sinergy is well-positioned to thrive in the evolving IVD distribution landscape. Its journey serves as a valuable case study for other IVD distributors looking to navigate the post-pandemic healthcare market. As the Indonesian healthcare sector continues to grow, with an expanding population and increasing healthcare awareness, PT. Sinergy Diagnostic has the potential to play an even more significant role in providing high-quality diagnostic solutions.

If you have related needs, please feel free to contact us for more information or product support.

Reference

This article is for research use only. Do not use in any diagnostic or therapeutic application.

Cat.No. GP-DQL-00203

Rotavirus Antigen Group A and Adenovirus Antigen Rapid Test Kit (Colloidal Gold)

Cat.No. GP-DQL-00206

Adenovirus Antigen Rapid Test Kit (Colloidal Gold), Card Style

Cat.No. GP-DQL-00207

Adenovirus Antigen Rapid Test Kit (Colloidal Gold), Strip Style

Cat.No. GP-DQL-00211

Rotavirus Antigen Group A Rapid Test Kit (Colloidal Gold), Card Type

Cat.No. GP-DQL-00212

Rotavirus Antigen Group A Rapid Test Kit (Colloidal Gold), Card Type

Cat.No. IP-00189

Influenza A Rapid Assay Kit

Cat.No. GH-DQL-00200

Follicle-stimulating Hormone Rapid Test Kit (Colloidal Gold)

Cat.No. GH-DQL-00201

Insulin-like Growth Factor Binding Protein 1 Rapid Test Kit (Colloidal Gold)

Cat.No. GH-DQL-00202

Luteinizing Hormone Rapid Test Kit (Colloidal Gold)

Cat.No. GH-DQL-00208

Follicle-stimulating Hormone Rapid Test Kit (Colloidal Gold), Strip Style

Cat.No. GH-DQL-00209

Insulin-like Growth Factor Binding Protein 1 Rapid Test Kit(Colloidal Gold), Strip Style

Cat.No. GH-DQL-00210

Luteinizing Hormone Rapid Test Kit (Colloidal Gold), Strip Style

Cat.No. IH-HYW-0001

hCG Pregnancy Test Strip

Cat.No. IH-HYW-0002

hCG Pregnancy Test Cassette

Cat.No. IH-HYW-0003

hCG Pregnancy Test Midstream

Cat.No. GD-QCY-0001

Cocaine (COC) Rapid Test Kit

Cat.No. GD-QCY-0002

Marijuana (THC) Rapid Test Kit

Cat.No. GD-QCY-0003

Morphine (MOP300) Rapid Test Kit

Cat.No. GD-QCY-0004

Methamphetamine (MET) Rapid Test Kit

Cat.No. GD-QCY-0005

Methylenedioxymethamphetamine ecstasy (MDMA) Rapid Test Kit

Cat.No. GD-QCY-0006

Amphetamine (AMP) Rapid Test Kit

Cat.No. GD-QCY-0007

Barbiturates (BAR) Rapid Test Kit

Cat.No. GD-QCY-0008

Benzodiazepines (BZO) Rapid Test Kit

Cat.No. GD-QCY-0009

Methadone (MTD) Rapid Test Kit

Cat.No. GD-QCY-0011

Opiate (OPI) Rapid Test Kit

Cat.No. ID-HYW-0002

Multi-Drug Test L-Cup, (5-16 Para)

Cat.No. ID-HYW-0005

Multi-Drug Rapid Test (Dipcard & Cup) with Fentanyl

Cat.No. ID-HYW-0006

Multi-Drug Rapid Test (Dipcard & Cup) without Fentanyl

Cat.No. ID-HYW-0007

Multi-Drug 2~14 Drugs Rapid Test (Dipstick & Dipcard & Cup)

Cat.No. ID-HYW-0008

Fentanyl (FYL) Rapid Test (For Prescription Use)

Cat.No. ID-HYW-0009

Fentanyl Urine Test Cassette (CLIA Waived)

Cat.No. ID-HYW-0010

Fentanyl Urine Test Cassette (Home Use)

|

There is no product in your cart. |